Venture-Backed App Business Insights

Build fast.

Grow smart.

A high-growth software business funded by investors and focused on scaling quickly through a SaaS or digital product.

Venture-Backed App Business Insights

Build fast.

Grow smart.

A high-growth software business funded by investors and focused on scaling quickly through a SaaS or digital product.

Venture-Backed App Business Insights

🏆 Overall Business Viability Score

💰 Profitability Score

🚀 Scalability Score

⏳ Time to Profitability Score

💸 Startup Cost Score

🛠️ Operational Complexity Score

📢 Marketing & Customer Acquisition Score

🤖 Automation & Passive Income Score

📈 Market Demand Score

⚠️ Competition Level Score

🌱 Sustainability & Longevity Score

📊 Revenue Stability Score

🏗️ Barrier to Entry Score

🎯 Target Market Size Score

🔧 Skill & Experience Requirement Score

📍 Location Flexibility Score

💼 Legal & Compliance Complexity Score

🔥 Economic Resilience Score

🔄 Recession Proof Score

🏁 Exit Strategy Score

Business Idea Overview:

A venture-backed app business focuses on launching a scalable, high-growth software product that solves a clear market problem, often backed by angel or VC funding. These businesses are built for speed, user growth, and recurring revenue—frequently aiming for acquisition or IPO.

📊 Earning Potential

The earning potential can be enormous—ranging from low five figures for early-stage apps to multi-million dollar valuations upon scaling or acquisition. If product-market fit is strong, VC funding allows rapid growth, pushing revenue into the 7–9 figure range.

⚠️ Earnings Disclaimer: Actual earnings vary based on niche, strategy, and execution. There is no guarantee of success, and results depend on effort, market conditions, and business management.

🛠️ Best Platforms & Tools

-

Figma (for UI/UX design)

-

Systeme.io (for funnel building)

-

Outscraper (for lead data)

-

Flodesk (for email marketing)

-

Brevo (for CRM & customer workflows)

-

GitHub or GitLab (for version control)

-

Make / Zapier (for automation)

Get the SaaS Landing Page Template on Flow & Design

⚠️ Biggest Challenge

Finding product-market fit quickly enough to justify burn rate and retain investor confidence.

💸 Startup Costs & Investment

Initial development costs can range from $10,000–$250,000+ depending on team size, complexity, and MVP scope. Many founders raise $500K–$5M in pre-seed or seed funding.

📢 Customer Acquisition Strategy

Performance marketing, social proof (case studies, testimonials), referral programs, SEO landing pages, partnerships, and influencer co-marketing. Early traction is often driven by paid ads or waitlists.

📈 Ideal Business Model

Recurring revenue models (monthly SaaS), usage-based pricing, freemium models with upsells, or high-ticket enterprise subscriptions

⏳ Time to Profitability

Often 1–3 years depending on growth rate, fundraising goals, and customer retention.

🚀 Key to Scaling

Retention + onboarding flow optimization, hiring the right growth team, iterating with customer feedback, and expanding marketing & sales funnels aggressively.

🤖 Automation & Passive Income Potential

While not entirely passive, many back-end tasks like onboarding, payments, email nurturing, and analytics can be fully automated using tools like Make or Systeme.io.

View Automation Tools

🏁 Exit Strategy

Acquisition by a larger tech company, merging with a complementary platform, or even IPO if scaled aggressively with strong financials and user base.

🌱 Sustainability & Longevity

If the app solves a real problem and adapts over time, it can evolve into a long-term brand. However, staying ahead of tech and user expectations is critical.

🔄 Market Trends & Demand

AI, productivity, automation, wellness, fintech, and creator economy apps are especially hot. Investors are actively backing innovation in these categories.

🆚 Competition Level

Highly competitive. Unless your app has a unique angle, you’ll face tough pressure. Niching down or targeting underserved audiences helps.

Sign up for SEO Flow and start your keyword research today. SEOFlow.app

📍 Location Flexibility

Fully remote. Teams and customers can operate globally.

Visit NomadWave’s Digital Nomad Community

🎯 Ideal Target Audience

Depends on the app’s purpose. B2B apps target startups, marketers, and teams. B2C apps often target creators, solopreneurs, or hobbyists.

🏗️ Operational Complexity

Medium to high. Requires managing dev sprints, customer support, marketing, compliance, and infrastructure. Can be streamlined with the right team and automations.

🔧 Required Skills & Experience

Technical knowledge helps, but non-technical founders can succeed by hiring developers and focusing on product/market fit, growth, and leadership.

💼 Legal & Compliance Considerations

Privacy policies, terms of service, GDPR compliance, and possible data regulations depending on the market (especially fintech, health, or edtech).

📊 Best Monetization Strategies

-

Subscriptions

-

Tiered SaaS pricing

-

Add-ons

-

Marketplace transactions

-

Affiliate commissions (for partner tools)

🔥 Recession & Economic Resilience

Tech apps that serve essential business needs or reduce costs tend to survive downturns. Consumer-focused apps may struggle if they’re “nice to have.”

💰 Earning Potential – Venture-Backed App Business

The earning potential of a venture-backed app business is extremely high—but it comes with big swings. Once product-market fit is established and user acquisition scales, monthly revenue can grow exponentially, especially with a SaaS or freemium-to-premium model.

Here’s what you can expect:

Early Stage (Pre-Revenue to MVP): $0–$5K/month. This stage often involves building the app, testing with users, and iterating the product. Many founders operate at a loss here while seeking investment.

Growth Stage (Seed to Series A): $10K–$250K+/month. With funding, teams expand, marketing ramps up, and recurring revenue begins to climb through subscriptions, in-app purchases, or usage-based pricing.

Mature Stage (Post-Series B+ or Exit): $1M–$100M+/year. Highly successful apps can reach eight to nine-figure exits or more—especially if acquired by larger tech companies.

🧠 What Increases Earning Potential:

Recurring revenue from subscriptions (SaaS)

High customer retention and low churn

Network effects (the more users, the more valuable)

Global scalability without major cost increases

Data or AI integration for upsell opportunities

💡 Example Exits:

Calm: $2B+ valuation

WhatsApp: Acquired for $19B by Facebook

Slack: Acquired for $27.7B by Salesforce

💬 Bottom Line:

Earning potential is uncapped—but hinges on execution, product-market fit, funding, and strategic scaling. For founders who understand the startup lifecycle, it can be one of the most financially rewarding business models in the world.

⚠️ Earnings Disclaimer: Actual earnings vary based on niche, strategy, and execution. There is no guarantee of success, and results depend on effort, market conditions, and business management.

📈 Ideal Business Model – Venture-Backed App Business

The ideal business model for a venture-backed app combines scalability, recurring revenue, and high margins. Investors typically look for business models that offer rapid growth potential, strong user retention, and predictable revenue streams.

Here are the best-performing models in this space:

1. SaaS (Software-as-a-Service)

-

How it works: Users pay a recurring subscription fee (monthly or annually) to access the app’s features.

-

Why it’s ideal: Predictable recurring revenue, scalable infrastructure, and high lifetime value (LTV).

-

Example: Notion, Figma, Zoom

2. Freemium to Premium

-

How it works: Users access a basic version of the app for free, with premium features unlocked through a subscription or one-time purchase.

-

Why it’s ideal: Low barrier to entry attracts mass users; monetization occurs through upsells.

-

Example: Spotify, Duolingo, Grammarly

3. Marketplace or Platform Fee Model

-

How it works: The app connects two sides (buyers and sellers) and takes a percentage of each transaction.

-

Why it’s ideal: Scales with user base and volume, requires no inventory.

-

Example: Uber, Airbnb, Upwork

4. Usage-Based Pricing

-

How it works: Users pay based on how much they use the app (e.g., API calls, storage, processing).

-

Why it’s ideal: Aligns pricing with value delivered and usage scale.

-

Example: AWS, Twilio

5. In-App Purchases (IAP) or Ads

-

How it works: Monetization through microtransactions or ad revenue.

-

Why it’s ideal: Great for mobile apps with large user bases, especially in gaming or entertainment.

-

Example: Candy Crush, TikTok

💡 Best Practices for Monetization:

-

Offer tiered pricing to serve different segments.

-

Include free trials or freemium tiers to drive adoption.

-

Focus on retention metrics (LTV, CAC, churn) to strengthen valuation.

📌 Bottom Line:

The ideal venture-backed app business model is scalable, sticky, and monetized through recurring revenue—with room to layer multiple streams (SaaS + marketplace + upsells) as the business grows.

Get JotPro, the intuitive AI writing tool with over 50 templates, and countless features like Speech-to-Text and Text-to-Speech. Sign Up Free

🎯 Conversion Tactics – Venture-Backed App Business

In a venture-backed app business, acquiring traffic is only half the battle—turning visitors into users (and users into paying customers) is where real growth happens. Your conversion strategy should focus on minimizing friction, maximizing clarity, and guiding users to that “aha!” moment as quickly as possible.

1. Clear, Benefit-Driven Landing Pages

Your app’s homepage and feature pages should focus on value, not just features.

-

Use powerful headlines that speak directly to pain points.

-

Add screenshots, short videos, or animations showing the app in action.

-

Highlight key outcomes, not just functionalities (e.g., “Save 10+ hours a week”).

2. Free Trial or Freemium Onboarding

Let users experience the app’s value before paying.

-

Offer a 7- to 14-day free trial with no credit card required.

-

Use a freemium model to remove signup friction and then upsell through value-based prompts.

3. Guided Onboarding & In-App Walkthroughs

A smooth onboarding experience increases activation rates dramatically.

-

Include checklists, welcome modals, or tooltip walkthroughs.

-

Show immediate value—ideally within the first 2–5 minutes of use.

-

Personalize onboarding based on user goals or role.

4. Urgency & Social Proof

Use psychological triggers to build trust and motivate faster decisions.

-

Show real-time testimonials, ratings, or number of users onboarded.

-

Use limited-time offers, countdowns, or “Only X seats left” CTAs for urgency.

-

Include logos of well-known customers or press mentions.

5. A/B Testing Everything

From pricing pages to button color, continuous testing optimizes conversions.

-

Test multiple versions of landing pages, CTAs, and trial lengths.

-

Optimize pricing structure (monthly vs. annual, tiered plans, etc.).

-

Track key metrics: activation rate, trial-to-paid conversion rate, churn.

6. Exit-Intent & Retargeting

Not every user will convert right away—follow up matters.

-

Use exit-intent popups to offer a demo, lead magnet, or discount.

-

Set up retargeting ads for visitors who abandoned sign-up or checkout.

-

Send personalized emails to nurture cold leads and re-engage trial users.

7. In-App Triggers & Upgrade Prompts

Smart prompts at the right time can move users to the next tier.

-

Highlight locked features that add value (e.g., “Upgrade to access X”).

-

Use tooltips or modals that recommend plan upgrades based on behavior.

-

Offer timed incentives like “Upgrade now and get 30% off for 3 months.”

8. Live Chat & Human Support

When stakes are high (especially for B2B apps), human interaction converts.

-

Offer live chat during key parts of the onboarding process.

-

Use chatbots or knowledge bases for common questions.

-

Provide a “Book a Demo” option for enterprise or high-ticket plans.

✅ Quick Conversion Checklist:

-

Clear, benefits-first landing page

-

Instant access to value (freemium/trial)

-

Personalized onboarding

-

A/B testing and data tracking

-

Urgency, scarcity, and social proof

-

Upgrade prompts + email automation

-

Live support for enterprise conversion

🧠 Final Insight:

Every step of your funnel should answer:

“What’s the next smallest action this user can take to get value—and how can we make it effortless?”

That’s how conversions compound in high-growth apps.

💡 Most Profitable Niches – Venture-Backed App Business

When it comes to building a venture-backed app, the most profitable niches are those that combine high demand, recurring revenue potential, and scalability. Below are the categories where apps tend to generate the most consistent and long-term income, especially when backed by investor capital.

1. AI-Powered Productivity & Automation

Apps that help users save time, streamline tasks, and increase output are extremely in demand. These tools are often adopted by individuals, teams, and enterprises alike—leading to strong monthly recurring revenue models and enterprise-level pricing tiers.

2. Fintech & Personal Finance

Apps in this category help users better manage, invest, or grow their money. Because of the value placed on financial empowerment, users are often willing to subscribe or engage in transactional models. This category also tends to attract repeat usage and data-driven optimizations.

3. Health, Wellness & Fitness

Wellness-focused apps see strong engagement thanks to their alignment with long-term lifestyle goals. From mental health to physical fitness to holistic wellbeing, users build habits around these apps, making retention high and monetization through subscriptions and upsells effective.

4. Education & Learning

Lifelong learning is on the rise, and users are willing to pay for apps that help them gain new skills, certifications, or knowledge. This space is ideal for recurring revenue, course purchases, or hybrid freemium models.

5. Creator Economy Tools

The creator economy continues to grow, and apps that help individuals build, manage, or monetize their audience are in high demand. These tools often experience viral adoption due to their networked nature and offer strong value through features like analytics, monetization, and automation.

6. Remote Work & Team Collaboration

As remote work becomes the norm, businesses of all sizes need tools to communicate, collaborate, and track productivity. Apps in this category benefit from business-to-business pricing, recurring subscriptions, and high stickiness within teams.

7. B2B SaaS for Niche Industries

Serving a highly specific industry or workflow often means low competition and high willingness to pay. These apps solve pressing problems for specific professions or verticals and can generate stable monthly revenue with relatively low churn.

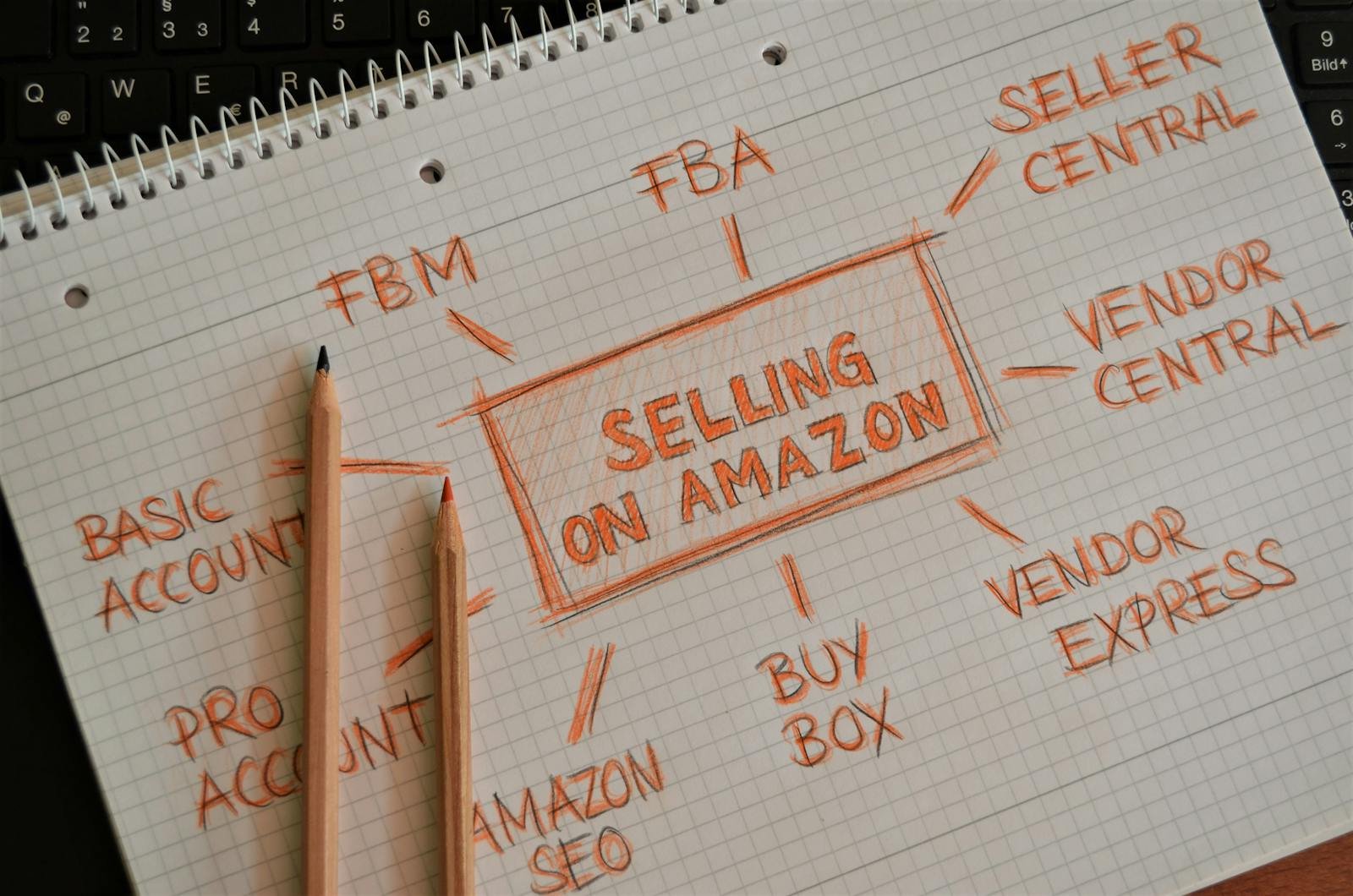

8. E-Commerce Enablement

Helping online sellers optimize their operations, boost sales, or automate customer interactions is a high-value space. Apps that directly support revenue generation often justify premium pricing and expand alongside their users’ businesses.

9. Sustainability & Green Tech

Apps focused on eco-conscious living, clean energy, or sustainable consumption appeal to value-driven consumers and brands. This niche benefits from growing consumer interest, government incentives, and long-term loyalty.

10. Parenting & Family Support

Apps that simplify parenting, support child development, or manage family life have strong retention due to the emotional and practical value they deliver. These audiences are highly engaged and likely to recommend useful tools to others.

📌 Final Thought:

The most profitable niches for venture-backed apps are often those with:

-

Recurring needs (e.g., health, finance, productivity),

-

Growing audiences (e.g., remote workers, creators),

-

And underserved markets (e.g., niche B2B or sustainable tech).

If your app can solve a real pain point, offer a frictionless experience, and build long-term engagement, you’re in a strong position to scale and secure funding.

💡 This vs. Other Business Models – Venture-Backed App Business

A venture-backed app business stands out significantly from most traditional or bootstrapped business models because of its growth-first philosophy, access to capital, and high-risk, high-reward nature.

🚀 Growth Over Profit (At First)

Unlike lifestyle businesses or bootstrapped startups that focus on profitability early, venture-backed apps often prioritize user acquisition and market share before profitability. The idea is to grow fast, dominate a market, and monetize at scale later.

💸 Access to Capital

With venture funding, app founders gain resources unavailable to most entrepreneurs—cash for hiring, product development, marketing, and scaling. This can accelerate success dramatically but also adds pressure for performance and eventual return on investment.

📈 Scalable Tech at the Core

Venture-backed app businesses usually build platform-based solutions that can scale to millions of users with relatively low incremental cost. This level of scalability and automation isn’t easily matched by service-based or physical product businesses.

🎯 Clear Exit Potential

This model is often built with a defined exit strategy in mind—whether it’s an acquisition, IPO, or merger. In contrast, other models like freelancing, consulting, or local businesses often require the owner’s presence and don’t scale well for exit.

🆚 Comparison With Other Models:

| Business Model | Scalability | Risk | Upfront Investment | Exit Potential |

|---|---|---|---|---|

| Venture-Backed App | Very High | High | High (VC-Funded) | Very High |

| E-commerce Store | Medium | Medium | Medium | Medium |

| Freelancing/Consulting | Low | Low | Low | Low |

| Coaching or Info Products | Medium | Medium | Low-Medium | Medium |

| Local Service Business | Low | Low | Medium | Low |

🧠 Final Takeaway:

While a venture-backed app business comes with higher stakes and expectations, it also offers the greatest upside in terms of scale, valuation, and industry impact. If you’re building something disruptive and have the vision to scale fast, this model offers a level of opportunity that few others can match.

🌟 Future Trends for Venture-Backed App Businesses

The future of venture-backed app businesses is poised for exponential growth, innovation, and disruption across multiple industries. Here are some key trends shaping the landscape:

📱 Hyper-Personalization

Apps are becoming increasingly tailored to individual users through AI and behavioral data. Future app businesses that can offer personalized experiences, content, and recommendations will outperform generic competitors.

🤖 AI & Automation Integration

Artificial intelligence, machine learning, and automation are no longer optional — they are central to app functionality and scaling. From chatbots and recommendation engines to predictive analytics and AI-driven features, venture-backed apps are expected to embed intelligent systems by default.

🌍 Global First, Local Adaptation

As funding increases, apps are launching globally from day one. However, successful ventures will localize their user experience, language, payment systems, and compliance to meet the needs of specific regions.

🌐 Web3 & Decentralization

Blockchain, tokenized rewards, decentralized identities, and user-owned data will play a growing role. Some venture-backed apps are exploring crypto-based monetization, smart contracts, and community governance.

📦 Subscription & Microtransaction Growth

Monetization models are shifting towards predictable income via subscriptions, memberships, and microtransactions. This trend increases revenue stability and lifetime value while lowering dependency on ads.

🔄 API Ecosystems & No-Code Expansion

Venture-backed apps will increasingly offer APIs or integrate with no-code platforms, allowing for customizable experiences and increased user engagement without needing to scale internal dev teams rapidly.

🧠 Mental Health, Wellness & Productivity Apps Rising

Investor interest continues to grow in wellness, mindfulness, focus, and productivity apps—especially those that support hybrid and remote workforces.

🛡️ Privacy & Compliance-First Architecture

As data regulations tighten globally (GDPR, CCPA, etc.), apps that build in privacy, consent management, and transparency from the ground up will gain investor confidence and user trust.

🔁 Continuous Monetization Innovation

From usage-based pricing to dynamic tiers and marketplace add-ons, the future will favor app businesses that test and optimize monetization models regularly to align with user behavior and market trends.

🚀 Faster MVPs & Fundraising Rounds

Thanks to incubators, pitch platforms, and lean startup frameworks, time-to-launch and time-to-funding are shrinking. Successful apps will prioritize rapid testing, user feedback loops, and clear traction to secure capital.

Bottom Line:

The next generation of venture-backed apps will be intelligent, scalable, privacy-first, and monetized through hybrid models. Founders who embrace these trends and build with future-forward frameworks will have a competitive edge in fundraising and market growth.

Want help building a simple, high-converting site to rent or scale your vehicle listings? Check out our business-ready templates at Flow & Design.

Updates on

Venture-Backed App Business

Get notified on new updates with the

Venture-Backed App Business ecosystem.

Sponsor

Reviews of Venture-Backed App Business

https://www.gezesrkog.com/

Dear,

I hope this email finds you well. I’m excited to introduce you to Cargoholidays.com, your gateway to a unique and adventurous way of exploring the world through cargo ship travel. As a leading cargo travel agency, we specialize in creating unforgettable journeys that offer a fresh perspective on travel and adventure.

At CargoHolidays, we understand that traditional travel experiences may not be for everyone, and that’s why we offer an alternative that’s both enriching and fascinating. Our cargo ship travel services open up a world of possibilities for those seeking a truly authentic and immersive travel experience.

I invite you to explore our website at CargoHolidays Website to browse our available routes at cargoholidays.com, destinations, and testimonials from fellow adventurers who have experienced the magic of cargo ship travel with us.

If you’re ready to embark on a one-of-a-kind journey or have any questions about our services, please don’t hesitate to contact us at contact@cargoholidays.com. Our dedicated team is here to assist you in planning your cargo ship adventure, providing insights, and addressing any queries you may have.

Safe travels and warm regards,